By David Callaway, Callaway Climate Insights

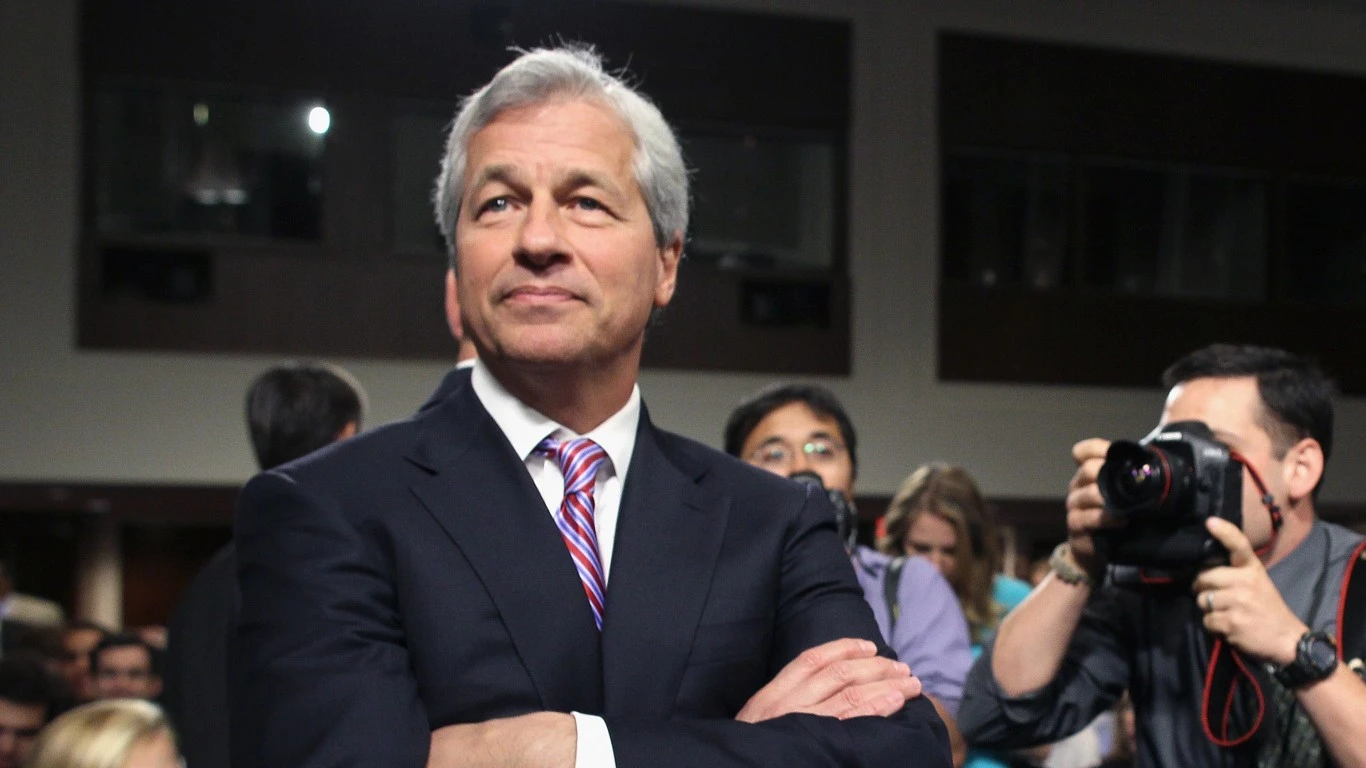

JPMorgan Chase & Co. leader Jamie Dimon put forth a well-articulated argument this week for building a European and U.S. energy security infrastructure in the wake of the havoc Russia has caused on world oil and gas (and food) markets with its invasion of Ukraine. A new Marshall Plan, he called it.

The Marshall Plan, named after former U.S. Secretary of State George Marshall, who called for a plan to rebuild Europe after World War II, is a great way to look at what we have so far called the energy transition. But it has a wartime context to it that is better tuned to galvanizing industry and government together to make change.

I went to the same school in New York that Dimon did, about seven or eight years behind, so it’s likely I learned about the Marshall Plan from the same teacher, Mr. Cook, at The Browning School. As I remember from Cook’s classes, the Marshall Plan was rare in that it had bipartisan support in Congress, something that seems impossible today. It also was a first step in uniting Europe across national borders, which ultimately led to a single currency. It secured U.S. influence on the continent, and lasted three years.

Climate advocates might wince at the Dimon plan, which includes rapid investment in oil and gas production as well as renewable energy. But that is happening anyway. President Joe Biden is expected to help announce an energy security policy in Europe either later today or tomorrow, which will include all forms, including nuclear.

A collective energy plan between Europe and the U.S., with financing, timelines, and dramatic, immediate action, is something that two decades of COP climate summits have failed to produce. It won’t be worth the horror of Putin’s War, but it would be a giant step forward for future energy security.

More insights below . . . .

Zeus: Oil’s up. Here come the windfall tax arguments

. . . . Like spring cherry blossoms and April showers, the inevitable call for a windfall tax on oil company profits blooms every time gasoline prices hit consumers hard at the pump, writes David Callaway. Several European countries and even the UK and the U.S. are debating a windfall tax, citing the Ukraine war’s unpredictable effect on oil prices. But the cost of a windfall tax to the value of free markets is too great. There is another, more immediate option to help consumers . . . .

Read the full Zeus column here

Thursday’s subscriber insights: Tech titans and the new nuclear age

. . . . One source of energy being increasingly eyed in light of the Ukraine war-caused energy crisis in nuclear. France is already ramping up and now Britain wants to as well. And you can add to that mix tech titans such as Elon Musk, Jeff Bezos, Bill Gates, Marc Andreesen and Peter Thiel, who are opening their wallets to fund a new breed of reactors. Read more here. . . .

. . . . Call them the orphan renewables. Geothermal and tidal. Both have the advantage of not being affected by weather and are not visually polluting. But they are more expensive to build and the technology is still in early stages. But what if they brought a side benefit? In this case, it is much-needed lithium. Read more here. . . .

Editor’s picks: We’re havin’ a heat wave; Audi’s picking up after itself

Extraordinary anomalies in #Antarctica lead to historic records today:

-Vostok 3489m -17.7C,monthly record beaten by nearly 15C !

-Concordia 3234m -12.2C,highest Temp. on records and about 40C above average !

-Dome C II 3250m -10.1C

-D-47 1560m -3.3C

-Terra Nova Base 74S +7.0C pic.twitter.com/w6Ry4Dy4wz— Extreme Temperatures Around The World (@extremetemps) March 18, 2022

‘Unprecedented,’ ‘unexpected’ Antarctic heat wave

Temperatures over the eastern Antarctic ice sheet are being recorded at 50 to 90 degrees above normal in a hot spell that has broken records and surprised researchers. In an email to the Washington Post, Jonathan Wille, a researcher studying polar meteorology at Université Grenoble Alpes in France, said, “this event is completely unprecedented and upended our expectations about the Antarctic climate system.” According to the report, parts of eastern Antarctica have seen temperatures near 70°F. (40°C.) above normal in recent days. The Post notes the abnormally high temperatures have caused some melting in the region according to models, “but this one melt event won’t affect the stability of the glaciers in that area.”

Audi veers toward microplastics solution

Audi reports that early field tests of its UrbanFilter project demonstrate the filters are efficient at preventing particles from tire wear and other pollutants from contaminating runoff into sewers, ground water and bodies of water. Audi’s Environmental Foundation is working with the Technical University of Berlin to create efficient filters to contain the estimated 110,000 tons of tire and road particles — microplastics — that end up on the roads and then being flushed into waterways in Germany alone every year. Without clogging up, the filters managed to permanently trap “genuine” street cleaning waste, cigarette filters, microplastics in the form of plastic granulates up to three millimeters in size, candy wrappers, and lids of disposable coffee cups, according to a news release from Audi. The carmaker, part of the Volkswagen Group, says the goal of the tests and of further development work is for the filter to be in operation for up to a year without having to be maintained or cleaned.

The future of corporate criminal liability in the ESG space

U.S. courts are not likely to follow the international pattern of finding a fundamental right to protection against climate change, but they are more likely to find potential corporate criminal liability for misrepresentations that corporations make to investors in the gap between what corporations say and what they do on climate change issues, says J.S. Nelson, author of The Future of Corporate Criminal Liability: Watching the ESG Space, in the Edward Elgar Research Handbook on Corporate Liability (forthcoming). The first movements in this evolution are already happening, Nelson writes in the abstract for this chapter. “This chapter focuses within ESG issues on potential U.S. corporate criminal liability for inaction to prevent climate change. There has not been discussion of this topic elsewhere in the literature, and businesses need to look for these developments in the law.” Author affiliations: Harvard Business School; Villanova Law School (on leave 2021-22); Villanova School of Business; The Wharton School, University of Pennsylvania; Institute for Corruption Studies.

Words to live by . . . .

“There is something infinitely healing in the repeated refrains of nature — the assurance that dawn comes after night, and spring after winter.” — Rachel Carson, marine biologist, conservationist and author of Silent Spring.