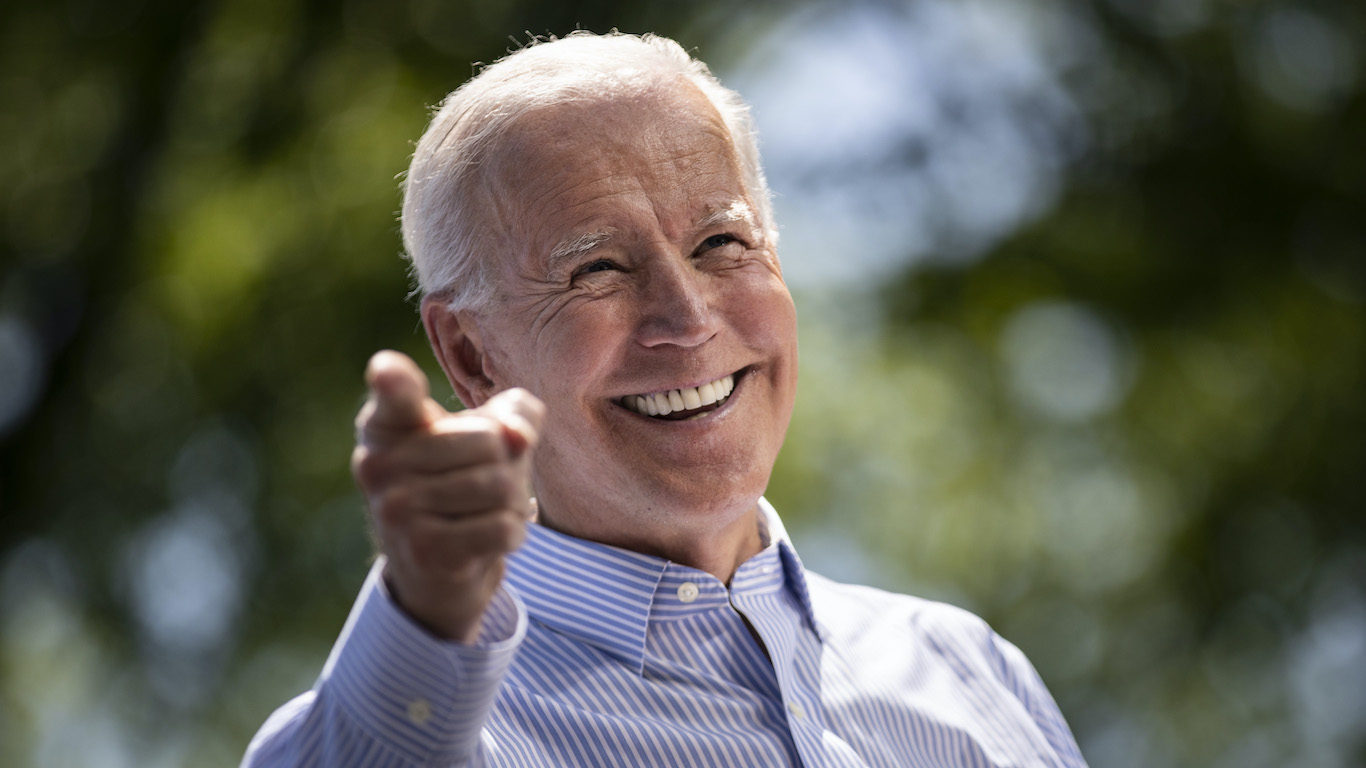

The success in passing President Biden’s climate bill, which will be signed by him this week, changes the game in the U.S fight against global warming. It also is a jolt in the arm to the flagging climate finance business this summer and its beleaguered ESG label.

The term ESG, for environmental, social and governance — once the hottest acronym on Wall Street — has been under attack for most of the year as clean energy stocks have been battered during the bear market. Political and financial opponents took cues from a series of setbacks in Europe and a Supreme Court ruling against environmental regulation to call for its removal as an investment requirement and overall renaming, saying the term is simply too broad and confusing to mean anything real.

Perhaps. But behind the discussion on terminology, banks, fund managers, and regulators continue to move toward an economic transition to renewable energy and all that entails, no matter what we decide to call it going forward.

“Has ESG slowed with market demand? The answer is no,” said Pablo Berrutti, senior investment specialist at the Sydney, Australia, branch of Stewart Investors. “I feel we’re kind of in the adolescence of where ESG is.”…

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.