By David Callaway, Callaway Climate Insights

. . . . COP26. No, it’s not a member of the Highway Patrol who will turn up when your car breaks down. Nor is it a Halloween prank (its start date was Oct. 31). Rather, it’s the 26th Conference of the Parties, also known as the annual UN climate change conference, in which up to 197 nations — though some may not show up — hash out pollution goals. Leaders hope to build on the 2015 Paris Agreement (agreed at COP21 in Paris), where 191 countries agreed to limit global warming below by reducing emissions by 55% by 2030.

This year the event is being held in Glasgow, a revitalized and trendy metropolis that is the fourth largest in the U.K. (See our guide to the city.) About 20,000 people — including scientists, policy experts and other advisers — will attend the talks, but who are the ones that really matter? Here’s our guide to the top honchos.

Key COP26 participants

Alok Sharma: As a U.K. Cabinet minister and president of COP26 — Italy also is an official host — Sharma’s job will be to keep the trains running on time, something that won’t be easy given competing agendas, particularly those of Western nations and large Asian countries.

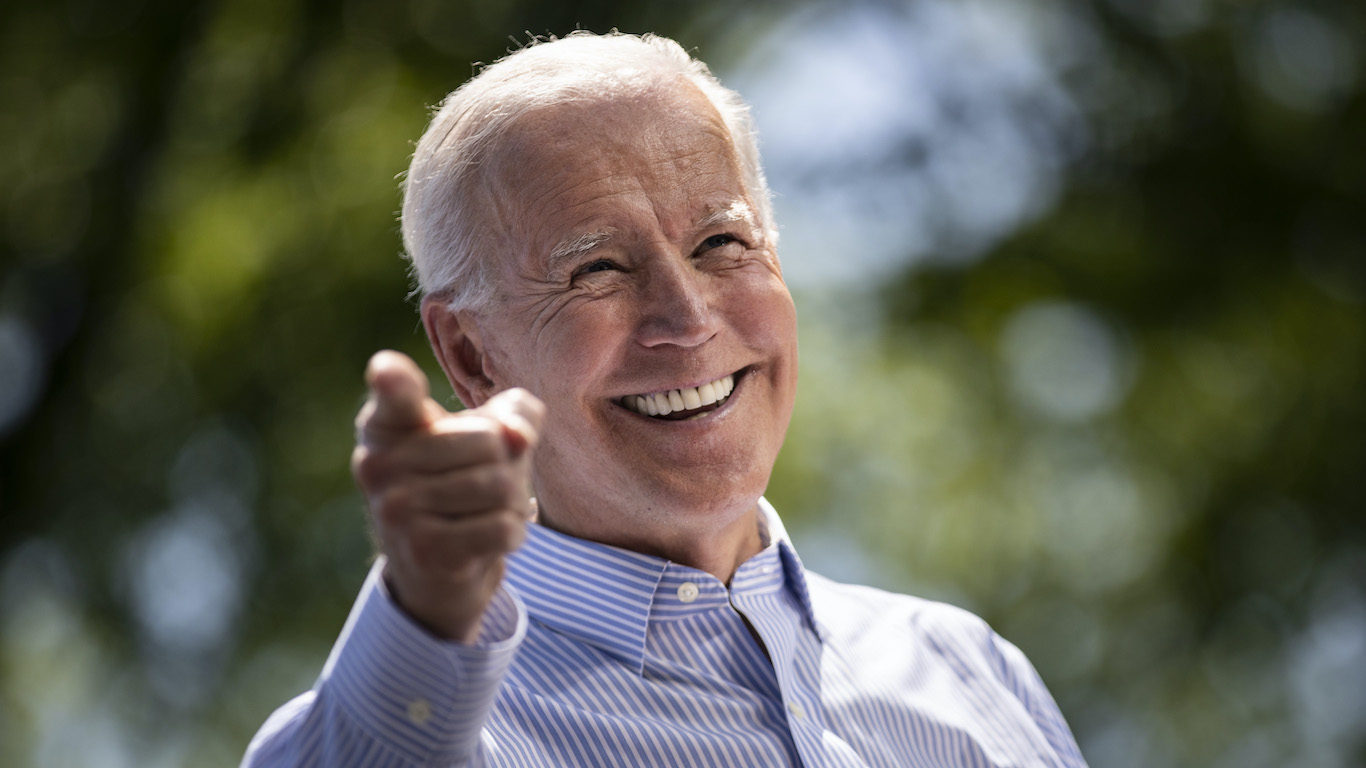

U.S. President Joe Biden: Having just scrambled in an attempt to save his multi-trillion-dollar spending proposal, Biden arrives at COP26 knowing that a large proportion of the surviving cash — more than half a trillion — will go to fighting climate change. That gives him a bully pulpit at the conference, but he is also hampered by perceived political weakness at home as dipping poll numbers in the face of rising prices, particularly of gasoline. However, Biden is quite a wizard at twisting arms and doing deals, so he could help keep COP26 from fizzling.

UK Prime Minister Boris Johnson: Despite often being pictured on a bicycle during his time as mayor of London, Johnson has not always been a climate change-fighting warrior, having pooh-poohed global warming in newspaper articles several years before taking the U.K.’s top job. However, he is now a relatively enthusiastic supporter of climate action and leads a nation that has made great strides in renewables, particularly in onshore and offshore wind power. He can be relied upon to use his combination of charm and backroom machinations to push other leaders toward his views and tactics.

UN Secretary General António Guterres: A scientist and former prime minister of Portugal, Guterres has embraced the battle against climate change as a key component of his job, having declared last year that human-caused pollution is “suicidal,” adding that “Nature always strikes back — and it is already doing so with growing force and fury.” With his fierce intelligence — he was named his nation’s best high school student back in 1965 — and political savvy, Guterres will be a key at what is, after all, a U.N. event.

Australian Prime Minister Scott Morrison: As a major coal, oil and gas producer that generates its power using 93% fossil fuels, the Land Down Under has become somewhat of a climate villain. Morrison is leader of the country’s Liberal Party, which, despite its name, is center right and tends to defend the massive coal industry, which is a major exporter and source of revenue. In this light, he refused to set net-zero emissions targets at the President Biden-led Leader Climate Summit in April. He has, however, changed his mind about attending COP26, having originally said he would not be there, so he might be open to deals.

Indian Prime Minister Narenda Modi: India, the world’s third-worst polluter (after China and the U.S.) is very dependent on coal as it seeks quick economic growth for its vast and ambitious population. However, it has been making big strides in renewables, particularly solar and wind power, and there were hopes a couple of years ago that Modi might declare a net-zero emissions target. However, with his nation being particularly hard-hit by Covid, that was put on hold; now, with the pandemic looking to be in the rearview mirror, fingers are being crossed that he will use COP26 to come through with a pledge.

John Kerry, U.S. special envoy on climate: As the U.S. secretary of state in 2015, Kerry signed the Paris Agreement on behalf of the Obama administration, a deal that was torn up by President Trump and restored by President Biden. Since his appointment in January, he has been racking up the miles visiting a slew of foreign capitals, particularly Beijing and New Delhi, the political denizens of which are key to fighting climate change. Expect more sweet-talking as he roams the halls in Scotland.

Mark Carney, former governor of the Bank of England: The Canada-born money man, educated at Harvard and Oxford, is both a U.N. special envoy for climate action and the finance adviser for the U.K.’s presidency of COP26. In his current and former roles — he was also governor of the Bank of Canada — COP watchers are looking to him to make the financial case for renewables in the face of pressure, especially from Asia and other developing areas, for speedy economic growth mainly based on fossil fuels.

Roberto Cingolani, Italy’s minister for ecological transition: Why is he important? Because he hosted the pre-COP meeting of environment-oriented national officials in Milan a few weeks back. Thus, he knows a lot of the players and also, as a decorated scientist, brings deep knowledge of the subject.

Ursula von der Leyen, president of the European Commission: The Belgium-born German, who also spent many years living in the U.S. and Britain, is particularly important to the process because the EU’s 27 nations — where she is its leading figure — will negotiate as a bloc. With Europe having recently seen renewables pass fossil fuels as the leading source of electrical power, the continent is seen as having strength in numbers, especially when dealing with China, with which it has many fewer political beefs than with the U.S.

Frans Timmermans: The former Netherlands foreign minister, who is the EU’s executive vice-president — and thus Ursula von der Leyen’s deputy — was instrumental in pushing through 2020’s EU Green Deal, which promised cleaner air with no loss in prosperity. His forceful yet charming personality — which was on display at a February webinar hosted by Callaway Climate Insights — is likely to be helpful in knocking heads together in pursuit of a COP26 deal.

Xie Zhenhua, China’s chief climate change official, and (probably) vice-environment minister Zhao Yingmin: With President Xi Jinping skipping the conference, all eyes will be on his senior envoys as many of the world’s nations trying to reign in the world’s worst polluter. That said, the voracious coal consumer has made big strides in renewables, having, for instance, recently become the biggest offshore wind power force, with solar not far behind. Xie, who has met several times with the U.S. climate envoy John Kerry, has reportedly earned respect from other climate leaders though has yet to persuade Xi to make a net-zero pledge. Zhao is more of an unknown quantity, but as a government minister has more weight in making changes.

Significant non-participants

Prince Charles: With his mother, Queen Elizabeth II, having decided to forgo a Glasgow trip — doctors advised that the 95-year-old needed rest — the mantle of royal representation will fall on her eldest son and heir. And it is fitting, given his deep interest in conservation and environmental matters, most recently manifested in the founding of Terra Carta, which asks businesses to sign a pledge that they will invest in the health of the planet. “I am making an urgent appeal to leaders, from all sectors and from around the world, to give their support to this Terra Carta,” he said at its launch in January, “to bring prosperity into harmony with nature, people and planet over the coming decade.” His sincerity is little in doubt; his clout, however, might not extend to the Xi Jinpings of this world. That said, companies such as BlackRock (BLK), Bank of America (BAC) and HSBC (HSBC) have signed on.

Greta Thunberg: The ubiquitous teen climate activist is in Glasgow in hopes of pressuring the COP26 participants with her passion and outspokenness. She is, however, not very hopeful of a positive outcome, having told The Guardian that “the leaders will say ‘we’ll do this and we’ll do this, and we will put our forces together and achieve this,’ and then they will do nothing. … We can have as many COPs as we want, but nothing real will come out of it.” A smooth politician she ain’t, as the Scottish would say, but sure to bring extra attention to the conference and its aims.

Missing in action

China’s President Xi Jinping: The Beijing boss made several excuses about not attending — too busy, fears of Covid, etc. — and there is no doubt his absence will put considerable doubt as to whether China will pledge a net-zero date. However, with its considerable progress on renewables and desire to be an even bigger global player, Beijing may strive to surprise.

Russia’s President Vladimir Putin: The leader of the world’s fourth-worst polluter tends not to go abroad much, and with its high pollution rates — and high exports of fossil fuels — Moscow probably thinks that wheeling out an Aeroflot executive jet is not worthwhile. In fact, expect de facto dictator Putin to be about the last in line to sign a net-zero document.

Brazil’s President Jair Bolsonaro: Will he? Won’t he? Turns out to be the latter for the controversial leader, who, in a bizarre announcement on Thursday, said he will instead visit a small town in Italy where some of his forebears lived to pick up an honorary citizenship. And under Bolsonaro, Brazil has become a bad world citizen, with vast tracts of the Amazon basin — a vital carbon sink — being cleared for agriculture along with other environmental no-nos. . . .

Callaway Climate Insights Newsletter

By Douglas McIntyre